Institutional Insights: Goldman Sachs Trading NFP's 16/12/25

Goldman Sachs expects a soft but not scary US labor report (covering both October and November), consistent with a gradually cooling labor market, but not a recession signal. Markets are quite sensitive to downside surprises, especially in rates and equities, given how much cyclical assets have rallied and how little recession risk is priced.

GS Economics: NFP & Labor Market Views

Headline numbers (GS estimates):

- Nonfarm payrolls (NFP):

- October: +10k (total), +70k (private)

- November: +55k (total), +50k (private)

- Consensus for November: +50k (GS is just slightly above).

- Unemployment rate:

- Expected to rise to 4.5% in November

- From an unrounded 4.44% in September (so the move is mostly rounding).

- Average hourly earnings (AHE):

- October: +0.30% m/m

- November: +0.35% m/m

- October has a neutral calendar effect; November has a positive one (slightly boosting the m/m print).

Special factors & caveats:

- Deferred resignation program:

- Creates uncertainty for headline payrolls.

- Doesn’t affect private payrolls, so private NFP is the cleaner signal of underlying job growth.

- Furloughed federal workers during the survey week may be temporarily counted as unemployed, nudging the unemployment rate higher.

- Net message: Labor market is cooling, not collapsing.

Market pricing context:

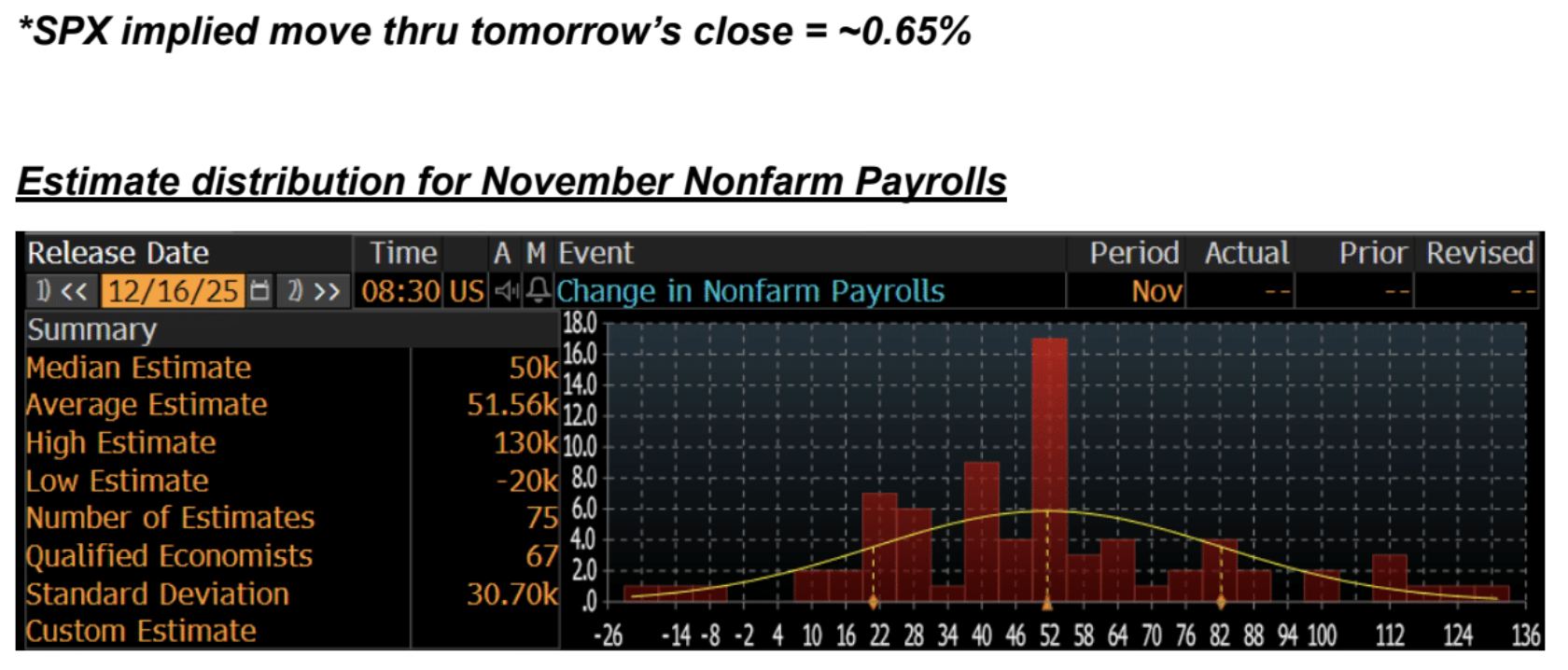

- SPX implied move through tomorrow’s close: ~**0.65%**.

- Front-end rates are only pricing about ~20 bps of cuts over the first three meetings in 2026 – so there’s asymmetry if the report is meaningfully weaker than expected.

GS Macro View (Vickie Chang)

Setup:

- This report is unusual: it’s delayed and covers two months (October and November).

- GS baseline: +55k NFP and 4.5% unemployment in November.

- Powell at the last FOMC:

- Sounded more concerned about downside labor risks.

- Did not strongly lean into a January pause, but emphasized data volatility and the need for a “skeptical eye.”

Risk skew:

- Markets are not really pricing recession fears, so:

- Rates asymmetry is to the downside: a negative labor surprise could hit risk and benefit front‑end rate longs.

- GS baseline is not a “bad” outcome:

- A report in line with their forecast would likely:

- Relieve near-term event risk, and

- Fit into a benign macro backdrop (no imminent recession).

If there’s a bigger downside surprise:

- Example trigger: unemployment rate 4.6%+.

- With limited cuts currently priced:

- Front-end longs (e.g., in US rates) look like good insurance.

- Equity hedges (puts, or trades linking lower equities + lower front-end yields) can make sense depending on existing risk.

GS Equity Strategy (Ryan Hammond)

Recent price action:

- Cyclicals vs Defensives:

- Cyclicals have rallied sharply in recent weeks.

- Outperformed Defensives on 14 consecutive days – longest stretch in 15+ years.

- The Cyclicals vs Defensives basket (GSPUCYDE) is up ~11% since Nov 20, now above its mid‑September high.

Interpretation:

- Clients are optimistic on the economy.

- Still, sector rotations imply the market is only pricing:

- A bit above 2% real GDP growth.

- GS cross‑asset tools suggest:

- A slightly more conservative outlook, broadly in line with consensus (not wildly bullish).

NFP implications for equities:

- If the labor market strengthens relative to expectations:

- Scope for broader equities, especially cyclicals, to move higher.

- But:

- Equity market is vulnerable to a material negative surprise in the labor data.

- Modest weakness could be partly offset by incremental Fed easing hopes, but a big downside surprise would likely hurt risk.

GS FX View (Karen Fishman)

Core view:

- Biggest potential headwind to Dollar shorts = labor market data, more than the December FOMC.

- Powell’s dovish tone recently:

- Allowed the Dollar to weaken,

- Helped cyclical assets across markets.

If the data comes in roughly as GS expects (moderate job growth, stable-ish unemployment):

- Markets may refocus on US reacceleration risk.

- That would weigh on:

- JPY, CHF, EUR (i.e., stronger USD vs these).

- But:

- There’s a limit to how high yields can go, because:

- Powell emphasized the volatility and need to discount some data.

- So EM carry should remain well supported.

- Cyclical FX (AUD, NZD, SEK) should be less sensitive to even large surprises.

Positioning notes:

- EM carry has turned higher vol, partly due to:

- AI-related equity wobbles,

- Political noise in Brazil and Hungary.

- Still, GS has high conviction long ZAR:

- Attractive fundamentals,

- Less exposed to China’s trade competitiveness pressure (a key theme for 2026).

- Preferred expression: long ZAR funded out of CAD, to:

- Reduce risk beta and vol.

- This hasn’t worked as expected recently because of hawkish repricing of the BoC, but GS thinks:

- The market is near the limit on how many hikes it can price while the BoC says it’s on hold.

If the labor market data significantly disappoints:

- Most positive for JPY, given:

- Heavy tactical short positioning.

- Magnitude of yen strength depends on:

- How much rates and equities reprice.

- Response could be more muted than usual if those markets don’t move dramatically.

GS Volatility / Options View (Joe Clyne)

Current vol setup:

- Market and implied vol have drifted lower into NFP.

- Dealer long gamma is keeping the market pinned (range‑bound).

- SPX one‑day straddle is pricing ~0.65% move into the print.

GS vol stance:

- They see “good news is good news” for equities:

- Stronger jobs → stocks up, especially cyclicals.

- On vol:

- There’s still room for implied vol to fall on a rally:

- Dealers get longer options on the topside,

- Front‑end vol is not yet at year‑to‑date lows.

- Preference:

- Short vol trades > long gamma trades at current pricing.

- Flows:

- Quiet overall into the print,

- Small uptick in customer hedging (some demand for protection, but not extreme).

Risk reminder (from GS):

- Max loss on options bought = premium paid.

- Max loss on options sold = unlimited.

Core Takeaways

- Macro data: GS expects moderate payrolls (+55k), higher unemployment (4.5%), and modest wage growth, consistent with a cooling but not breaking labor market.

- Rates: Asymmetry skewed toward downside surprise risk; front-end longs are good insurance if unemployment jumps (≥4.6%).

- Equities: Cyclicals have rallied hard; stronger labor = more room up, but equities are vulnerable to a big negative surprise.

- FX: Baseline supports USD vs JPY/CHF/EUR; EM carry (especially long ZAR funded vs CAD) still favored, but with higher volatility.

- Vol: Implied move is modest (~0.65%); GS leans short vol, seeing room for vol to compress if the report is benign and equities rally.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!